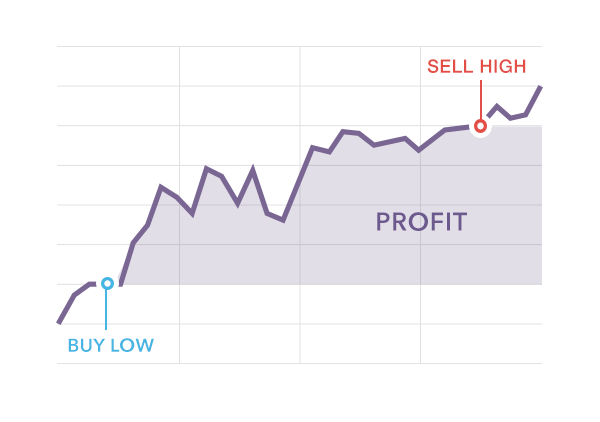

Most people think about trading in just one direction. They imagine buying an asset (‘going long’) before the price begins to rise. Then they imagine selling it just as it reaches its peak to reap a profit.

While this is an excellent goal for any trader to aim for, it’s by no means the only potential way to capitalise on market movements.

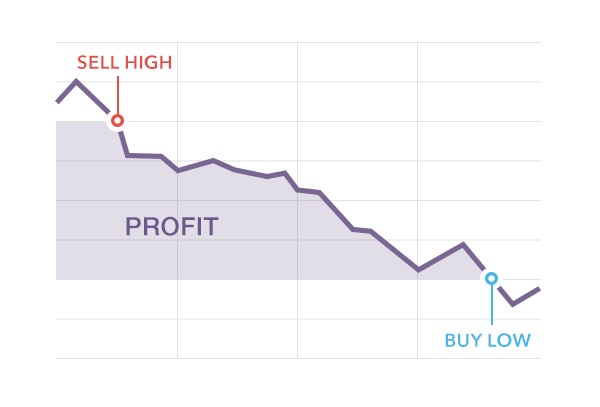

Opportunities can also arise in markets that are heading for a downturn, and in this section we’ll see how you can trade these by ‘going short’ or ‘short selling’.

What is short selling?

When you go long, you open your trade by buying an asset whose value you expect to rise and close it by selling – hopefully for a higher price.

To go short, you do the opposite.

You sell to open a short trade and buy to close it.

So, if you believe an asset’s price is set to fall, you might decide to sell it now in the hope of later buying it back at a lower price to make a profit.

Of course, you may logically assume that you first need to own the asset concerned in order to sell it. But in fact this isn’t the case: it’s possible to effectively borrow the asset so you can sell it short.

How does short selling work?

The easiest way to explain this is through an example.

Let’s say that shares in XYZ plc are trading at 1000p. Jonathan decides to borrow 100 XYZ plc shares from his stockbroker to short-sell, as he believes the price will soon fall.

Jonathan’s broker lends him the shares, borrowing them from its own inventory, another client’s holdings, or perhaps another brokerage. It sells the shares for Jonathan and credits his account with the proceeds (£1000).

The XYZ plc share price then falls to 800p, and Jonathan decides to close (or ‘cover’) his trade. The broker therefore buys 100 shares for him, deducting the purchase cost of £800 from his account and returning the shares to their original owner.

This leaves Jonathan with a gross profit of £200 in his account. His broker will also charge commission for handling the transaction, the lender will require a borrowing fee, and there could be other costs for the trade, which we’ll discuss shortly.

| Proceeds of sale to open trade (100 x 1000p) | £1000 |

|---|---|

| Cost of covering (100 x 800p) | £800 |

| Gross profit | £200 |

Question

In the same scenario, how would Jonathan fare if XYZ plc’s share price rose to 1200p (rather than falling to 800p) after he opened his short trade?

What are the limitations?

In Jonathan’s trade above, he was able to borrow the shares he needed through his broker. But what if his broker didn’t hold any XYZ plc shares and nobody wanted to lend the stock? If XYZ plc was ‘unborrowable’ at the time, Jonathan would have been unable to make his short trade.

Similarly, a lender might occasionally need to ask for its stock back while a short trade is in progress. This is known as ‘being called away’. If it happens to you, even if you’re not ready to close your trade yet, you may be obliged to cover.

It’s also worth being aware that brokers may sometimes be unable to offer short trading facilities, for example for assets below a certain value. It’s up to each brokerage to set its own criteria, so a different firm may be able to help you if this happens.

Question

When selling an asset you don’t own, there are certain consequences to be aware of. For example, suppose you borrow shares in ABC plc to sell short, and the company then declares a dividend.

The lender who provided your ABC plc shares, Rebecca, is due to receive this dividend. But so too is the buyer to whom you’ve sold the borrowed shares, George. (Strangely, at this point the shares effectively have two owners simultaneously).

ABC plc will pay the dividend to George, who is now the official listed owner of the shares. So who must pay Rebecca?