In the previous lesson, you were introduced to cryptocurrencies and learned why they’re different from traditional currencies.

Aside from functioning as a new kind of “digital money” that’s used to pay for goods and services, cryptocurrencies are more often used as financial assets that people trade or invest in.

The traditional financial (“TradFi”) industry is still divided on whether crypto should be considered a “financial asset”.

The popular argument is that they’re impossible to value because there are no earnings or dividends, but there are financial assets with similar issues like gold and other commodities.

I view cryptocurrencies as a financial asset. More broadly, I view cryptocurrencies as a brand new asset class. (Currently, a very speculative asset class.)

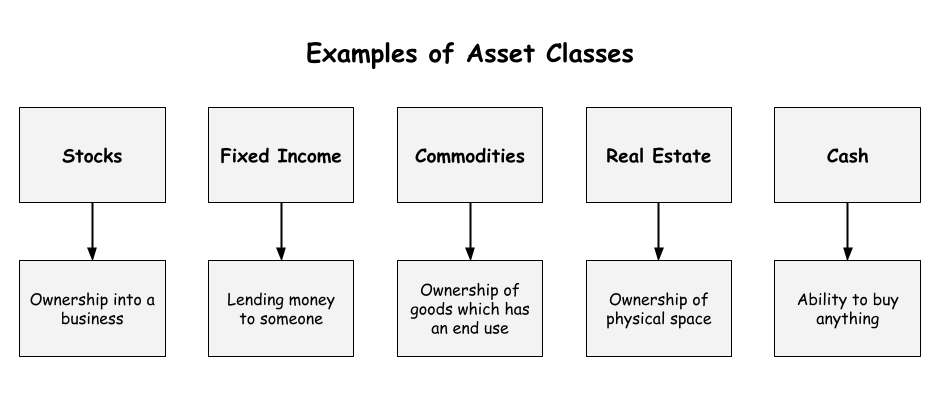

Asset classes are categories of investments that have similar characteristics and behave in a similar way such as stocks, bonds, commodities, real estate, and cash (fiat currencies).

And now there’s…crypto!

Crypto represents the first truly new asset class in decades. 🤯

Rather than just being used as a means of payment, like to pay for food at a restaurant, most cryptocurrencies are used to make speculative trades or held as investments by people who expect their value to rise.

Similar to the forex market, which is the financial market for fiat currencies, there’s now a crypto market, a financial market for cryptocurrencies, where both traders and investors can make money.

But while the forex market is open 24 hours a day, 5.5 days a week, the crypto market is open 24 hours a day, 7 days a week. It never closes!

Traders make bets (“speculate”) on short-term price direction, while investors buy and hold in hopes that certain cryptocurrencies gain wider user adoption and increase in value over the long term.

Adding crypto helps investors diversify their portfolios. And more experienced crypto investors even generate passive income from different cryptocurrencies they hold.

Since cryptocurrencies are financial assets that you can invest or trade, they’re also referred to as “digital assets” or “cryptoassets” or “crypto assets“.

Examples of Crypto

The first cryptocurrency was Bitcoin and it remains the biggest and most well-known.

There are also other well-known cryptocurrencies like Ethereum, Cardano, Solana, Dogecoin, Polkadot, Litecoin, Cosmos, and many others.

Some are similar to Bitcoin. Others are based on different technologies, or have new features that make them totally different from Bitcoin.

The term “cryptocurrency” is actually misleading because, unlike Bitcoin, most cryptocurrencies do not function as actual currencies.

Today, there are now THOUSANDS of cryptocurrencies that have been created, with each trying to offer new or improved functionalities from earlier cryptocurrencies or to serve a totally different purpose or use case.

Unfortunately, many are actually useless or even worse, outright scams, but a lot of people still buy them.

Gullible noobs entering the crypto world hear about “A coin that will not only change the world but change the galaxy!”

They think: “I must buy this Galaticoin!”

They buy the dubious coin and give away their money without understanding the underlying technology.

The cryptocurrency ends up being worthless.

Some people are jumping into the crypto market with the wrong mentality. They believe that it’s a sure bet….that the money they put in will just automatically grow.

With this mentality, it’s not surprising why a scam artist or shiller sees today’s cryptocurrency market like how a tiger sees a herd of one-legged deer.

Lots of delicious opportunities.

Don’t be a one-legged deer.

That’s my mission…

“Don’t let you become a one-legged deer.”